Whether or not you’re a economic advisor, investment issuer, or other fiscal Specialist, check out how SDIRAs may become a strong asset to expand your organization and attain your Expert objectives.

Greater Fees: SDIRAs often come with larger administrative expenses in comparison with other IRAs, as specific elements of the administrative system can not be automatic.

If you’re hunting for a ‘set and forget about’ investing technique, an SDIRA likely isn’t the correct choice. Since you are in full Handle around each and every investment built, It really is your choice to carry out your individual homework. Bear in mind, SDIRA custodians are usually not fiduciaries and can't make suggestions about investments.

The tax strengths are what make SDIRAs eye-catching For lots of. An SDIRA may be the two regular or Roth - the account type you select will rely mostly on your own investment and tax tactic. Look at with your monetary advisor or tax advisor should you’re Uncertain and that is finest in your case.

Criminals sometimes prey on SDIRA holders; encouraging them to open up accounts for the objective of generating fraudulent investments. They typically fool investors by telling them that Should the investment is approved by a self-directed IRA custodian, it have to be genuine, which isn’t true. All over again, You should definitely do extensive research on all investments you decide on.

Constrained Liquidity: A lot of the alternative assets which can be held within an SDIRA, for example property, non-public equity, or precious metals, will not be effortlessly liquidated. This may be an issue if you'll want to access cash rapidly.

Incorporating cash on to your account. Remember that contributions are matter to yearly IRA contribution limitations set by the IRS.

Have the liberty to take a position in Just about any sort of asset which has a danger profile that fits your investment method; like assets which have the probable for the next rate of return.

Choice of Investment Possibilities: Make sure the supplier allows the categories of alternative investments you’re keen on, for instance property, precious metals, or non-public equity.

And because some SDIRAs which include self-directed standard IRAs are issue to needed minimum amount distributions (RMDs), you’ll have to site here prepare in advance to make certain that you have enough liquidity to satisfy The principles established by the IRS.

Earning the most of tax-advantaged accounts allows you to keep more of the money that you devote and get paid. Based upon irrespective of whether you end up picking a conventional self-directed IRA or possibly a self-directed Roth IRA, you've got the prospective for tax-totally free or tax-deferred growth, delivered selected ailments are satisfied.

Put simply just, in the event you’re looking for a tax economical way to develop a portfolio that’s a lot more tailored on your interests and expertise, an SDIRA may very well be the answer.

Because of this, they have an inclination not to advertise self-directed IRAs, which supply the flexibility to take a position in a broader variety of assets.

An SDIRA custodian is different as they have the right team, expertise, and capacity to maintain custody in the alternative investments. Step one in opening a self-directed IRA is to find a supplier which is specialized in administering accounts for alternative investments.

The principle SDIRA policies through the IRS that traders need to have to grasp are investment limitations, disqualified individuals, and prohibited transactions. Account holders need to abide by SDIRA guidelines and laws to be able to preserve the tax-advantaged position in their account.

Yes, real estate property is one of our purchasers’ hottest investments, occasionally termed a real estate property IRA. Clientele have the choice to take a position in every thing from rental Attributes, business property, undeveloped land, property finance loan notes and even more.

Compared with stocks and bonds, alternative assets will often be harder to offer or can come with rigid contracts and schedules.

This includes knowing IRS restrictions, running investments, and staying away Extra resources from prohibited transactions that can disqualify your IRA. A scarcity of knowledge could cause high-priced issues.

Sometimes, the fees related to SDIRAs could be larger plus much more intricate than with a daily IRA. It's because with the greater complexity connected to administering the account.

Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Catherine Bach Then & Now!

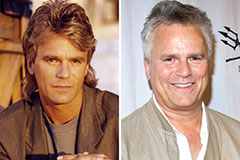

Catherine Bach Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!